Bank Customer Churn Prediction Model

Predict, Prevent, and Prosper - Predicting Churn with Machine Learning

Link to project repository on GitHub

Goal: build a machine learning model to predict if a bank's customer will churn (leave the bank) or not.

For each instance in the test set, you must predict a 0 or 1 value for the target variable (Classifier).

Steps

- EDA

- data.describe()

- Pie chart

- Correlation heatmap

- Histograms

- KDE plots

- Univariate Exploration

- Feature Engineering (note I will train models on original features and engineered features separately)

- Age Group: grouping customers into age categories to capture non-linear relationships and improve the model’s ability to identify patterns.

- Balance to Estimated Salary Ratio: provides insight into a customer's financial stability. A higher ratio may indicate financial strain, which could increase the likelihood of the customer leaving the bank.

- Tenure Group: grouping tenure into categories to capture non-linear effects and reduce noise.

- Loyalty Index: a composite feature reflecting customer loyalty, combining tenure, the number of products held, and whether they are an active member.

- Balance Above 0: a binary feature indicating whether the customer's account balance is at or above zero.

- Preprocessing

- Split data

- Create pipeline

- OneHot encoding

- StandardScaler

- Create Models

- Model 1: Random Forest Classifier

- Model 2: Logistic Regression

- Model 3: Support Vector Machine

- Model 4: K-Nearest Neighbours

- Model 5: XGBoost

- Visualize models:

- Confusion matrix

- Display feature importance (when applicable)

- Create Models with Engineered Features

- Repeat above (10 models total)

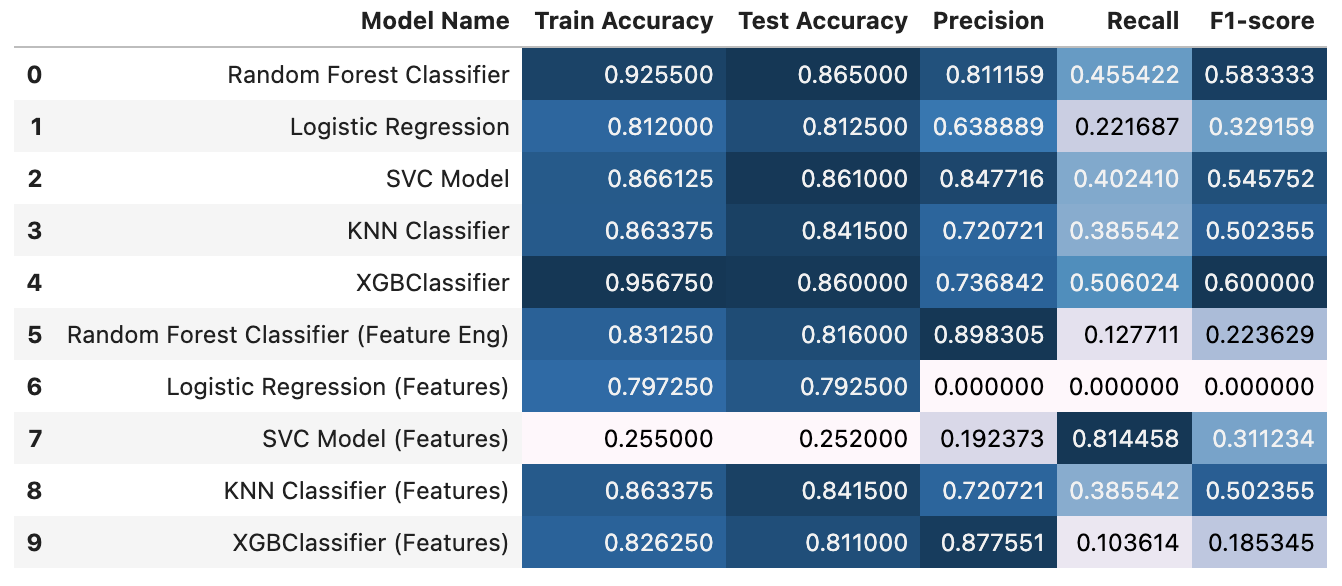

Result of Model Evaluations

- Best Performing Model: Random Forest Classifier

- Worst Performing Model: SVC Model (Features)

- Interestingly, models trained on the original features outperformed those utilizing feature-engineered data. Investigating the reasons behind this unexpected result could provide valuable insights into the feature engineering process and its impact on model performance.

- Age appears to be a significant predictor of customer churn. This finding suggests that the bank should explore the underlying reasons for why age is such a strong indicator. Implementing targeted promotions or incentives for customers in high-risk age groups could effectively reduce churn and retain these valuable customers.

Data

The dataset used in this project is available publicly on Kaggle: https://www.kaggle.com/datasets/shrutimechlearn/churn-modelling

Technologies

Python- pandas, numpy, matplotlib, seaborn

- sklearn (OneHotEncoder, StandardScaler, make_column_transformer, ColumnTransformer, Pipeline, RandomForestClassifier, LogisticRegression, SVC, KNeighborsClassifier, XGBClassifier, cross_val_score, GridSearchCV, ConfusionMatrixDisplay)

- XGBoost